2025-08-29

Risk management is not simply about cutting losses or setting a stop-loss level. For professional traders, especially those preparing for or working with prop firms, the question is: How can I allocate capital so that each position contributes equally to portfolio risk, regardless of market volatility or asset class?

This concept is the foundation of Risk Parity Portfolio Construction. While risk parity is traditionally applied to multi-asset portfolios (stocks, bonds, commodities), forex traders can also leverage the same logic to stabilize returns and reduce the destructive impact of volatility clustering.

In this blog, we will explore how forex traders can implement risk parity, the tools required to calculate volatility-adjusted allocations, and how this method can align with prop firm rules.

Risk parity is a portfolio construction technique where allocation is based on risk contribution rather than capital contribution.

Mathematically, risk contribution is tied to volatility and correlation:

Forex markets are unique compared to equities:

Risk parity helps forex traders in three ways:

For prop traders, this is not just a theory—it directly affects survival in challenge phases and long-term capital management.

The foundation is calculating volatility for each pair. Traders often use:

Example:

If you allocate $10,000 equally, GBP/JPY contributes far more risk than EUR/USD. In risk parity, GBP/JPY’s allocation will be reduced.

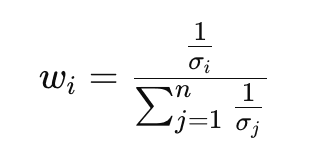

Risk parity uses inverse volatility weighting:

Where:

This ensures that higher volatility pairs automatically get smaller allocations.

If two pairs are highly correlated (EUR/USD and GBP/USD), risk parity penalizes duplication. Traders often use a correlation matrix to reduce overlapping exposure.

Advanced methods include:

Forex traders often add leverage after achieving a balanced risk portfolio. For example:

This avoids the classic problem of under-leveraging low-volatility pairs like EUR/USD.

Choose a diverse basket—avoid over-concentration in USD majors. Example:

Use a rolling 20-day ATR or realized volatility.

Allocate according to inverse volatility.

Check correlation over a 60–90 day window. Reduce exposure to highly correlated pairs.

Match prop firm rules: don’t exceed daily drawdown risk.

Traders must monitor the portfolio dynamically and rebalance frequently.

Instead of fixed lookback windows, volatility is estimated adaptively—shorter during high volatility, longer during calm markets.

Forex pairs respond differently depending on global macro cycles. Risk parity can integrate regime detection models to allocate differently in “risk-on” vs “risk-off” markets.

ML models can predict volatility clusters, feeding into risk parity allocation. For example:

Assume a prop trader has $100,000 capital. They select 4 pairs:

Inverse volatility weights:

Final adjusted allocations:

Now, each pair contributes equally to total portfolio risk—protecting the trader from sudden shocks in USD/TRY or GBP/JPY.

Risk parity is not only quantitative—it also affects trader psychology.

Risk parity sits in the middle: practical, conservative, and adaptive.

For forex prop traders, building a risk parity portfolio is more than a theoretical exercise—it is a survival strategy. By ensuring each trade contributes equally to overall portfolio risk, traders reduce concentration risk, stabilize equity growth, and align with the stringent rules of funding firms.

Risk parity does not guarantee profits, but it maximizes risk efficiency, which is the ultimate currency for professional traders.

2025 Ай Трейдер Глобал ХХК | Компанийн бүртгэлийн дугаар: 15962

Ай Трейдер Глобал ХХК нь Комор улсын Анжуан арал дахь Мутсамуду хотын Хамчакод байрлалтай. Тус компани нь Коморын Үнэт Цаасны Хорооноос (Securities Commission of the Comoros) олгосон L15962/ITGL дугаартай тусгай зөвшөөрлийн хүрээнд үйл ажиллагаа явуулдаг.

Ай Трейдер Глобал ХХК нь “iTrader” нэрийн дор үйл ажиллагаа явуулдаг бөгөөд (Форекс) арилжааны үйл ажиллагаа явуулах эрхтэй. Компанийн лого, барааны тэмдэг, вэбсайт нь зөвхөн Ай Трейдер Глобал ХХК компанийн өмч юм.

Ай Трейдер Глобал ХХК -ийн охин компани болох : iTrader Global Pty Ltd, Австралийн компанийн бүртгэлийн дугаар (ACN): 686 857 198. Энэ компани нь Opheleo Holdings Pty Ltd компанийн албан ёсны төлөөлөгч бөгөөд Австралийн санхүүгийн үйлчилгээний төлөөлөгчийн дугаар: 001315037 -тай. Австралийн санхүүгийн үйлчилгээний лицензийн дугаар: 000224485 -тай Level 1, 256 Rundle St, Adelaide, SA 5000 хаягт байршдаг. Анхааруулга: Энэ байгууллага нь энэхүү вэбсайт дээр болон дамжуулан арилжаалагдаж буй санхүүгийн (арилжааны) хэрэгсэл нийлүүлэгч биш бөгөөд ямар нэгэн хариуцлага хүлээхгүй болно.

Эрсдэлийн сэрэмжлүүлэг: CFD арилжааны хөшүүргийн улмаас хөрөнгөө хурдан алдах өндөр эрсдэлтэй тул бүх хэрэглэгчдэд тохиромжгүй байдаг.

Фанд, CFD болон бусад өндөр xөшүүрэгтэй арилжаа нь хэрэглэгчээс нарийн төвөгтэй ойлголтуудын талаар тусгай мэдлэг шаарддаг. Хөшүүрэгтэй арилжаанд оролцогчдын 84.01% нь алдагдал хүлээдгийг судалгаанууд харуулдаг тул хөшүүрэгтэй арилжаанд орохоос өмнө хөрөнгөө алдах маш өндөр эрсдэлтэй болохыг анхаарна уу.

iTrader нь аливаа иргэн, хуулийн этгээдийн өмнө xөшүүрэгтэй арилжааны эрсдэл, алдагдал, бусад хохирлыг бүхэлд нь хариуцахгүй болохыг мэдэгдэж байна.

Энэхүү веб сайтын мэдээ, мэдээлэл нь зөвхөн мэдлэг түгээх зорилготой тул хэрэглэгч та бие даан шийдвэр гаргана уу.

Хязгаарлалт: iTrader нь вэбсайт болон үйлчилгээгээ тухайн орны хууль тогтоомж, дүрэм журмаар хориглосон орнуудад оршин суугчдад чиглүүлдэггүй. Хэрэв та энэхүү вэбсайтыг ашиглахыг хориглосон оронд байгаа бол вэбсайт болон үйлчилгээг ашиглахдаа тухайн орны хууль тогтоомжид нийцэж байгаа эсэхийг шалгах үүрэгтэй. iTrader нь вэбсайтынхаа мэдээлэл бүх оронд тохиромжтой эсэхийг баталгаажуулдаггүй.

Ай Трейдер Глобал ХХК нь зарим улс орны иргэдэд үйлчилгээ үзүүлэхээс татгалздаг болно. Жишээлбэл: АНУ, Орос, Бразил, Канада, Израйл, Иран.