2025-08-29

Risk management is not simply about cutting losses or setting a stop-loss level. For professional traders, especially those preparing for or working with prop firms, the question is: How can I allocate capital so that each position contributes equally to portfolio risk, regardless of market volatility or asset class?

This concept is the foundation of Risk Parity Portfolio Construction. While risk parity is traditionally applied to multi-asset portfolios (stocks, bonds, commodities), forex traders can also leverage the same logic to stabilize returns and reduce the destructive impact of volatility clustering.

In this blog, we will explore how forex traders can implement risk parity, the tools required to calculate volatility-adjusted allocations, and how this method can align with prop firm rules.

Risk parity is a portfolio construction technique where allocation is based on risk contribution rather than capital contribution.

Mathematically, risk contribution is tied to volatility and correlation:

Forex markets are unique compared to equities:

Risk parity helps forex traders in three ways:

For prop traders, this is not just a theory—it directly affects survival in challenge phases and long-term capital management.

The foundation is calculating volatility for each pair. Traders often use:

Example:

If you allocate $10,000 equally, GBP/JPY contributes far more risk than EUR/USD. In risk parity, GBP/JPY’s allocation will be reduced.

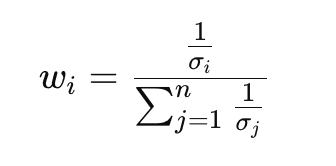

Risk parity uses inverse volatility weighting:

Where:

This ensures that higher volatility pairs automatically get smaller allocations.

If two pairs are highly correlated (EUR/USD and GBP/USD), risk parity penalizes duplication. Traders often use a correlation matrix to reduce overlapping exposure.

Advanced methods include:

Forex traders often add leverage after achieving a balanced risk portfolio. For example:

This avoids the classic problem of under-leveraging low-volatility pairs like EUR/USD.

Choose a diverse basket—avoid over-concentration in USD majors. Example:

Use a rolling 20-day ATR or realized volatility.

Allocate according to inverse volatility.

Check correlation over a 60–90 day window. Reduce exposure to highly correlated pairs.

Match prop firm rules: don’t exceed daily drawdown risk.

Traders must monitor the portfolio dynamically and rebalance frequently.

Instead of fixed lookback windows, volatility is estimated adaptively—shorter during high volatility, longer during calm markets.

Forex pairs respond differently depending on global macro cycles. Risk parity can integrate regime detection models to allocate differently in “risk-on” vs “risk-off” markets.

ML models can predict volatility clusters, feeding into risk parity allocation. For example:

Assume a prop trader has $100,000 capital. They select 4 pairs:

Inverse volatility weights:

Final adjusted allocations:

Now, each pair contributes equally to total portfolio risk—protecting the trader from sudden shocks in USD/TRY or GBP/JPY.

Risk parity is not only quantitative—it also affects trader psychology.

Risk parity sits in the middle: practical, conservative, and adaptive.

For forex prop traders, building a risk parity portfolio is more than a theoretical exercise—it is a survival strategy. By ensuring each trade contributes equally to overall portfolio risk, traders reduce concentration risk, stabilize equity growth, and align with the stringent rules of funding firms.

Risk parity does not guarantee profits, but it maximizes risk efficiency, which is the ultimate currency for professional traders.

© 2025 iTrader Global Limited|会社登録番号:15962

iTrader Global Limitedは、コモロ連合のアンジュアン自治島ムツァムドゥのHamchakoに所在し、コモロ証券委員会によって認可・規制を受けています。ライセンス番号は L15962/ITGL です。

iTrader Global Limitedは「iTrader」の商号で運営しており、外国為替取引業務を行う許可を受けています。会社のロゴ、商標、ウェブサイトはすべて iTrader Global Limited の専有財産です。

iTrader Global Limitedの他の子会社には、iTrader Global Pty Ltd(オーストラリア会社登録番号(ACN):686 857 198)が含まれます。 この会社は、Opheleo Holdings Pty Ltd(オーストラリア金融サービスライセンス(AFSL)番号:000224485)の認可を受けた代表者(AFS代表番号:001315037)です。登録住所は Level 1, 256 Rundle St, Adelaide, SA 5000 です。

免責事項: この法人は、本ウェブサイト上で取引される金融商品の発行者ではなく、それらに対して責任を負いません。

リスク警告: 差金決済取引(CFD)は、レバレッジにより資本の急速な損失リスクが高く、すべての利用者に適しているとは限りません。

ファンド、CFD、その他の高レバレッジ商品を取引するには、専門的な知識が必要です。

調査によると、84.01%のレバレッジ取引者が損失を被っています。取引を開始する前に、リスクを十分に理解し、資金を失う可能性があることを認識してください。

iTraderは、レバレッジ取引によるリスク、損失、またはその他の損害について、個人または法人に対して一切の責任を負わないことを明言します。

利用制限: iTraderは、法律、規制、または政策によりこのような活動が禁止されている国の居住者を対象として、本ウェブサイトやサービスを提供していません。