2025-08-29

Risk management is not simply about cutting losses or setting a stop-loss level. For professional traders, especially those preparing for or working with prop firms, the question is: How can I allocate capital so that each position contributes equally to portfolio risk, regardless of market volatility or asset class?

This concept is the foundation of Risk Parity Portfolio Construction. While risk parity is traditionally applied to multi-asset portfolios (stocks, bonds, commodities), forex traders can also leverage the same logic to stabilize returns and reduce the destructive impact of volatility clustering.

In this blog, we will explore how forex traders can implement risk parity, the tools required to calculate volatility-adjusted allocations, and how this method can align with prop firm rules.

Risk parity is a portfolio construction technique where allocation is based on risk contribution rather than capital contribution.

Mathematically, risk contribution is tied to volatility and correlation:

Forex markets are unique compared to equities:

Risk parity helps forex traders in three ways:

For prop traders, this is not just a theory—it directly affects survival in challenge phases and long-term capital management.

The foundation is calculating volatility for each pair. Traders often use:

Example:

If you allocate $10,000 equally, GBP/JPY contributes far more risk than EUR/USD. In risk parity, GBP/JPY’s allocation will be reduced.

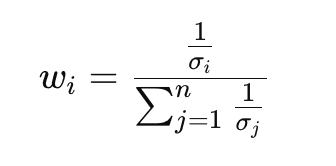

Risk parity uses inverse volatility weighting:

Where:

This ensures that higher volatility pairs automatically get smaller allocations.

If two pairs are highly correlated (EUR/USD and GBP/USD), risk parity penalizes duplication. Traders often use a correlation matrix to reduce overlapping exposure.

Advanced methods include:

Forex traders often add leverage after achieving a balanced risk portfolio. For example:

This avoids the classic problem of under-leveraging low-volatility pairs like EUR/USD.

Choose a diverse basket—avoid over-concentration in USD majors. Example:

Use a rolling 20-day ATR or realized volatility.

Allocate according to inverse volatility.

Check correlation over a 60–90 day window. Reduce exposure to highly correlated pairs.

Match prop firm rules: don’t exceed daily drawdown risk.

Traders must monitor the portfolio dynamically and rebalance frequently.

Instead of fixed lookback windows, volatility is estimated adaptively—shorter during high volatility, longer during calm markets.

Forex pairs respond differently depending on global macro cycles. Risk parity can integrate regime detection models to allocate differently in “risk-on” vs “risk-off” markets.

ML models can predict volatility clusters, feeding into risk parity allocation. For example:

Assume a prop trader has $100,000 capital. They select 4 pairs:

Inverse volatility weights:

Final adjusted allocations:

Now, each pair contributes equally to total portfolio risk—protecting the trader from sudden shocks in USD/TRY or GBP/JPY.

Risk parity is not only quantitative—it also affects trader psychology.

Risk parity sits in the middle: practical, conservative, and adaptive.

For forex prop traders, building a risk parity portfolio is more than a theoretical exercise—it is a survival strategy. By ensuring each trade contributes equally to overall portfolio risk, traders reduce concentration risk, stabilize equity growth, and align with the stringent rules of funding firms.

Risk parity does not guarantee profits, but it maximizes risk efficiency, which is the ultimate currency for professional traders.

© 2025 iTrader Global Limited | 회사 등록번호: 15962

iTrader Global Limited는 코모로 연방 앙주앙 자치섬의 무잠두(Hamchako, Mutsamudu)에 위치하고 있으며, 코모로 증권위원회(Securities Commission of the Comoros)의 인가 및 규제를 받고 있습니다. 당사의 라이선스 번호는 L15962/ITGL입니다.

iTrader Global Limited는 “iTrader”라는 상호로 운영되며, 외환 거래 활동에 대한 인가를 받았습니다. 회사의 로고, 상표 및 웹사이트는 iTrader Global Limited의 독점 재산입니다.

iTrader Global Limited의 다른 자회사로는 iTrader Global Pty Ltd가 있으며, 이 회사는 호주 회사 등록번호(ACN): 686 857 198을 보유하고 있습니다. 해당 회사는 Opheleo Holdings Pty Ltd의 공식 대리인(AFS 대표 번호: 001315037)이며, Opheleo Holdings Pty Ltd는 호주 금융서비스 라이선스(AFSL 번호: 000224485)를 보유하고 있습니다. 등록 주소는 Level 1, 256 Rundle St, Adelaide, SA 5000입니다.

면책 조항: 이 회사는 본 웹사이트에서 거래되는 금융 상품의 발행인이 아니며 이에 대해 책임을 지지 않습니다.

위험 고지: 차액결제거래(CFD)는 레버리지로 인해 자본 손실이 빠르게 발생할 수 있는 높은 위험을 수반하며, 모든 사용자에게 적합하지 않을 수 있습니다.

펀드, CFD 및 기타 고레버리지 상품의 거래에는 전문적인 지식이 요구됩니다.

연구 결과에 따르면 레버리지 거래자의 84.01%가 손실을 경험하고 있습니다. 거래에 참여하기 전에 관련 위험을 충분히 이해하고 전체 자본을 잃을 준비가 되어 있는지 확인하십시오.

iTrader는 레버리지 거래로 인해 발생하는 손실, 위험 또는 기타 피해에 대해 개인 또는 법인에게 전적인 책임을 지지 않음을 명시합니다.

이용 제한: iTrader는 해당 활동이 법률, 규제 또는 정책에 따라 금지된 국가의 거주자를 대상으로 본 웹사이트나 서비스를 제공하지 않습니다.