2025-08-29

Risk management is not simply about cutting losses or setting a stop-loss level. For professional traders, especially those preparing for or working with prop firms, the question is: How can I allocate capital so that each position contributes equally to portfolio risk, regardless of market volatility or asset class?

This concept is the foundation of Risk Parity Portfolio Construction. While risk parity is traditionally applied to multi-asset portfolios (stocks, bonds, commodities), forex traders can also leverage the same logic to stabilize returns and reduce the destructive impact of volatility clustering.

In this blog, we will explore how forex traders can implement risk parity, the tools required to calculate volatility-adjusted allocations, and how this method can align with prop firm rules.

Risk parity is a portfolio construction technique where allocation is based on risk contribution rather than capital contribution.

Mathematically, risk contribution is tied to volatility and correlation:

Forex markets are unique compared to equities:

Risk parity helps forex traders in three ways:

For prop traders, this is not just a theory—it directly affects survival in challenge phases and long-term capital management.

The foundation is calculating volatility for each pair. Traders often use:

Example:

If you allocate $10,000 equally, GBP/JPY contributes far more risk than EUR/USD. In risk parity, GBP/JPY’s allocation will be reduced.

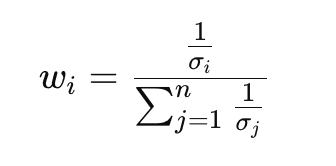

Risk parity uses inverse volatility weighting:

Where:

This ensures that higher volatility pairs automatically get smaller allocations.

If two pairs are highly correlated (EUR/USD and GBP/USD), risk parity penalizes duplication. Traders often use a correlation matrix to reduce overlapping exposure.

Advanced methods include:

Forex traders often add leverage after achieving a balanced risk portfolio. For example:

This avoids the classic problem of under-leveraging low-volatility pairs like EUR/USD.

Choose a diverse basket—avoid over-concentration in USD majors. Example:

Use a rolling 20-day ATR or realized volatility.

Allocate according to inverse volatility.

Check correlation over a 60–90 day window. Reduce exposure to highly correlated pairs.

Match prop firm rules: don’t exceed daily drawdown risk.

Traders must monitor the portfolio dynamically and rebalance frequently.

Instead of fixed lookback windows, volatility is estimated adaptively—shorter during high volatility, longer during calm markets.

Forex pairs respond differently depending on global macro cycles. Risk parity can integrate regime detection models to allocate differently in “risk-on” vs “risk-off” markets.

ML models can predict volatility clusters, feeding into risk parity allocation. For example:

Assume a prop trader has $100,000 capital. They select 4 pairs:

Inverse volatility weights:

Final adjusted allocations:

Now, each pair contributes equally to total portfolio risk—protecting the trader from sudden shocks in USD/TRY or GBP/JPY.

Risk parity is not only quantitative—it also affects trader psychology.

Risk parity sits in the middle: practical, conservative, and adaptive.

For forex prop traders, building a risk parity portfolio is more than a theoretical exercise—it is a survival strategy. By ensuring each trade contributes equally to overall portfolio risk, traders reduce concentration risk, stabilize equity growth, and align with the stringent rules of funding firms.

Risk parity does not guarantee profits, but it maximizes risk efficiency, which is the ultimate currency for professional traders.

© 2025 iTrader Global Limited|公司註冊編號:15962

iTrader Global Limited 註冊於科摩羅聯盟昂儒昂自治島穆扎穆杜 Hamchako,並受科摩羅證券委員會授權與監管。我們的牌照編號為 L15962/ITGL。

iTrader Global Limited 以「iTrader」為商業名稱經營,獲得從事外匯交易活動之授權。公司標誌、商標與網站均為 iTrader Global Limited 之專有財產。

iTrader Global Limited 的其他子公司包括:iTrader Global Pty Ltd,澳洲公司註冊編號(ACN):686 857 198。該公司是 Opheleo Holdings Pty Ltd 的授權代表(澳洲金融服務代表編號:001315037),Opheleo 持有澳洲金融服務執照(AFSL 編號:000224485),註冊地址為:Level 1, 256 Rundle St, Adelaide, SA 5000。

免責聲明:本實體並非本網站所交易金融產品之發行者,亦不對其負責。

風險提示: 差價合約(CFD)交易因槓桿效應具高度資本迅速損失風險,未必適合所有使用者。

參與基金、差價合約及其他高槓桿商品交易,需具備專業知識。

研究顯示,84.01% 的槓桿交易者最終蒙受損失。請務必充分了解相關風險,並在投入資金前確保自身已準備好承擔全部損失的可能性。

iTrader 特此聲明,對任何個人或法人因槓桿交易所導致之風險、損失或其他損害,概不承擔全部責任。

使用限制: iTrader 並不向法律、法規或政策禁止此類活動的國家或地區居民提供網站或服務。如您居住於限制使用本網站或服務之司法管轄區,您有責任自行確保遵守當地法律。